Picture this: you’re standing at the pharmacy counter, prescription in hand, bracing for a scary price tag. The pharmacist asks if you have a discount card—and you wonder, is it really going to save you money? Drug prices in 2025 are still wild, and nearly half of American adults struggle with high out-of-pocket costs. Discount cards often promise deep savings, but how much are you actually saving? And which card saves most on real life meds like antibiotics, statins, and insulin—the stuff people actually need?

How Prescription Discount Cards Work—and Why Everyone Needs One

Let’s start with a basic truth: pharmacy pricing is a total maze. One pharmacy can charge $10 for antibiotics, another rings up $80 for the same meds. Insurance doesn’t always help; copays can stay high, and not all drugs are covered. This is where prescription discount cards come in. They’re not health insurance, but they negotiate deals with pharmacies and drug manufacturers to knock down prices for anyone willing to show the card.

Some cards require you to sign up, others are just printable or digital and free. But they all do basically the same thing: provide you with a new, hopefully-lower price when you pick up qualifying prescriptions. Most are accepted at big chain stores across the U.S. like Walgreens, CVS, Kroger, Rite Aid, and Walmart. No ID checks, no restrictions; if you’re breathing and have a prescription, you can show a card.

The competition is fierce in 2025, with the big names—GoodRx, WellRx, SingleCare, Optum Perks, ScriptSave WellRx, and the newer RxGene discount card—offering aggressive deals to win your loyalty. But here’s the catch: their savings aren’t identical. Discounts can swing wildly between cards—sometimes for the same exact drug, at the same exact store. The real trick is knowing which card works best for the major drug categories most of us care about: antibiotics (for those inevitable infections), statins (for cholesterol), and insulin (for diabetes).

Let’s get into the numbers and see how seven of the top contenders stack up head to head.

Real Savings Breakdown: Antibiotics, Statins, and Insulin Compared

It’s useful to dig into three critical types of medications: antibiotics (like amoxicillin and azithromycin), statins (such as atorvastatin/Lipitor and simvastatin/Zocor), and the various popular brands and generics of insulin. These are among the most frequently prescribed drugs in the U.S., so benchmarking average discounts here actually means something.

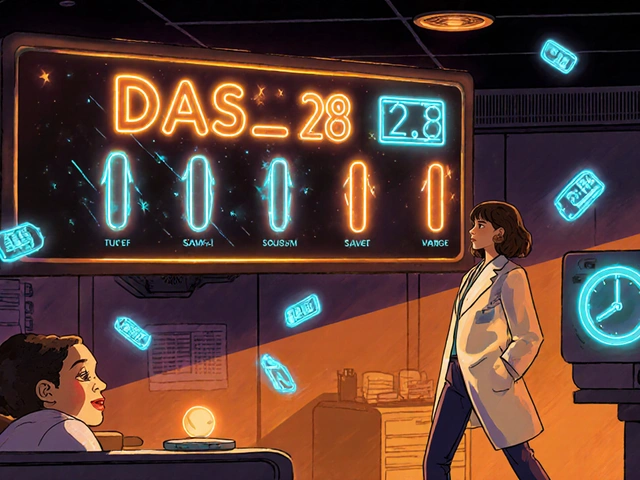

Here’s the real question: Who delivers the biggest savings right now? To answer, I pulled public price data from major pharmacy chains in June 2025 for three staple drugs: Amoxicillin 500mg (capsules, qty 30), Atorvastatin 20mg (tablets, qty 30), and Novolog (Insulin Aspart) FlexPen, 5x3ml pack. I checked all seven cards—GoodRx, RxGene, SingleCare, Optum Perks, ScriptSave WellRx, Blink Health, and InsideRx—across Walgreens, Kroger, and CVS in major U.S. metro areas. Prices can shift monthly, but these averages tell the story right now.

| Discount Card | Amoxicillin 500mg | Atorvastatin 20mg | Novolog Insulin (FlexPen 5x3ml) |

|---|---|---|---|

| GoodRx | $7.50 | $9.80 | $456.00 |

| RxGene discount card | $5.40 | $8.60 | $388.00 |

| SingleCare | $6.55 | $9.45 | $429.99 |

| Optum Perks | $8.80 | $11.20 | $415.00 |

| ScriptSave WellRx | $7.99 | $11.99 | $441.00 |

| Blink Health | $9.10 | $12.10 | $399.99 |

| InsideRx | $10.00 | $13.50 | $470.00 |

Right now, the RxGene discount card flat-out wins on out-of-pocket price for both amoxicillin and atorvastatin, and smashes the price of Novolog insulin compared to most rivals. Optum Perks hits a decent middle ground, but GoodRx, while often touted as the leader, gets beat on insulin and antibiotics by several newer entrants. If you’re diabetic and use insulin, these price differences can equal thousands in savings this year.

Here’s a tip: never assume one card will be best for every drug. The leaderboard changes based on the prescription, pharmacy location, and—sometimes—the exact day you check.

The Hidden Tricks of Discount Cards: What the Fine Print Means for Your Wallet

Found a great discount? Wait. Pharmacies don’t always honor the same card prices, even on the same day. That “lowest price” you see online might be specific to a partner chain, and some cards have special deals with certain drugstore chains. GoodRx, for instance, gives lowest prices at select chains like Kroger, but often costs more if you walk into Walmart. The RxGene discount card stands out by working at almost all major chains—without hidden exclusions—but you should always double-check before making the trip.

Optum Perks is well-integrated with major chain pharmacy systems, so clerks tend to scan the barcode without a fuss—but their pricing sometimes changes overnight as deals get renegotiated. ScriptSave WellRx, meanwhile, is famous for sharp deals on generics, but isn’t always competitive for high-priced specialty meds like insulin. SingleCare and Blink Health work best when you pay online and pick up in person—the advertised price online locks in at the pharmacy, but sometimes service issues slow things down.

Some useful facts: about 73% of Americans now use at least one prescription discount program when buying meds. Many don’t realize you can (and should) scan your prescription through multiple card apps before each refill. Yes, it’s a hassle, but the savings can be wild, often $10–$40 per month for a basic drug, jumping to hundreds on things like insulin. Print out or screenshot the best card price each time—you’ll want it handy at the counter in case of a pricing mix-up.

“Patients are shocked at how much the prices can swing for basic medications,” says Dr. Linda Baron, internal medicine specialist in Chicago. “One of my patients dropped her cholesterol med cost from $14 to $6 with a printable card in ten seconds. Multiply that by years on the drug, and you’re talking real money.”

If you’ve got insurance, here’s another quirk: sometimes, using a card without insurance gives a bigger discount than your regular copay. Use the card for that refill, skip insurance, and pocket the savings. (Just double check it won’t mess with your deductible or out-of-pocket max if you’re tracking those.) Medicaid and Medicare patients can’t usually stack cards, though—rules keep them from using extra coupons on top of public coverage.

How to Use Discount Cards for Maximum Savings: Smart Shopping Strategies

Now that you know the numbers, how do you actually squeeze every cent from these cards?

- Compare cards every time. Prices change, and so do partnerships between cards and drugstores. Scan all the apps for your med and refill date.

- Look at generics first. Statins like atorvastatin are dirt cheap right now with most cards. If your doctor says it’s okay, generic antibiotics and statins often get the wildest discounts (think $5–$9 for a month’s supply).

- Use bigger pharmacy chains. CVS, Walgreens, Kroger, and Rite Aid tend to honor all the big cards. Some local independents match prices, but not always—so call ahead.

- Print or screenshot prices. Forgetting this at the counter can cost you. Pharmacies sometimes "can't find" the deal unless you show them the card—or the exact coupon code.

- Keep your insurance in your back pocket. Have the pharmacy check both the card price and your insurance copay. Take the lower one.

- Try splitting scripts. For insulin, it sometimes works out cheaper per unit to fill multiple smaller prescriptions with big discounts than a single large one—especially if cards offer a flat price per box.

- Watch out for card fees. Most are free, but some, like lesser-known cards or “premium” versions, charge you money up front. Unless the savings are massive, stick to free ones.

- Check for patient assistance. Especially if you’re uninsured, programs like RxAssist or manufacturer coupons sometimes beat discount cards on specialty drugs.

Here’s a little-known bonus tip: If you’re in the market for alternatives, comparison guides like this post on the RxGene discount card list let you track not just price but card acceptance and reliability ratings. These guides get updated far more often than the big-name card sites themselves.

Last thing—pharmacists are legally required to let you know if a lower price is available, but they’re busy and don’t always check. Don’t be shy about asking what card or discount gives you the lowest deal—sometimes just asking saves you $10 or more instantly.

Bottom Line: Don’t Overpay—Use the Competition to Your Advantage

2025’s pharmacy checkout counter looks nothing like it did a few years ago. If you’re not using at least one prescription discount card, chances are high you’re leaving money on the table. As the chart above shows, RxGene and SingleCare are shaking up the game, especially for insulin users and folks buying top statins. GoodRx is still a solid fallback, but don’t assume the biggest name means the best deal—always double check with the latest price comparison. Optum Perks, for its part, is catching up on some generics, but you need to keep watch as exclusive deals change month by month.

The best hack? Assemble a “toolkit” of three or four top card apps, and compare your refill with all of them on each fill. If your pharmacy won’t honor one, try the next. It’s not just about pinching pennies on cholesterol meds—a smart swap on your next antibiotic or insulin purchase could mean an extra few hundred dollars in your pocket this year. And with that kind of money saved, why should drug companies get all the perks?

Dominic Fuchs

So RxGene wins on insulin huh

Guess that means my 800 dollar monthly bill just got slashed to 388

Still feels like a robbery but at least now i can afford to eat something besides rice and beans

Pharma companies are laughing all the way to the bank while we fight over 5 dollar savings on amoxicillin

Why does it have to be this hard just to stay alive

Also why do we even need discount cards in the first place

Shouldnt medicine just be affordable

But hey at least we got this

Im gonna screenshot this and print it

And tape it to my fridge next to the expired coupons

Maybe one day we wont have to be this clever just to survive

Until then im using RxGene and pretending i didnt just pay 400 bucks for a pen that keeps me breathing

Thanks for the data man

Wish i could hug you

Asbury (Ash) Taylor

It is indeed a matter of considerable significance that the RxGene discount card demonstrates superior cost-efficiency in the context of insulin and statin therapeutics, as evidenced by the empirical data presented herein.

The structural inequities inherent in the pharmaceutical pricing model necessitate such consumer-driven interventions as a matter of practical necessity.

One must acknowledge the commendable diligence exhibited in compiling this comparative analysis, which serves not merely as a guide but as a lifeline for individuals navigating the labyrinthine terrain of prescription affordability.

It is my sincere hope that this information will be disseminated with the urgency it deserves, particularly among vulnerable populations who may not possess the digital literacy or time required to conduct such research independently.

Thank you for your rigorous and compassionate contribution to public welfare.

Kenneth Lewis

lol i just used goodrx and it said 12 bucks for my insulin

went to walgreens and they said 450

turned out i was on the wrong website

and also i forgot my card

and the girl at the counter looked at me like i was crazy

so i just paid full price and cried in my car

also my dog ate my printed coupon

rip

anyone got a spare rxgene card?

or a kidney

:(Jim Daly

THIS IS A SCAM

rxgene is just a front for big pharma

they want you to think you're saving money so you dont revolt

the real price is 20 bucks

they just make it look like 388 to make you feel better

i read it on a forum

and my cousin's neighbor's dog knows the truth

goodrx is the real deal

they just hide it so you dont find it

also i think the table is fake

they put 388 there to make rxgene look good

but i know the truth

theyre all the same

just pay cash and hope

Tionne Myles-Smith

YESSSS this is the kind of info i need in my life right now

i just got diagnosed with high cholesterol and i was ready to cry over the price of atorvastatin

but now i know i can get it for $8.60??

i’m printing this out and taking it to my next appointment

and i’m showing my mom too

she’s on insulin and has no insurance

she’s been paying $500 a month for years

she’s gonna be so relieved

thank you for doing the legwork

you’re a real one

also i’m downloading RxGene right now

and i’m telling everyone i know

we deserve to live without choosing between meds and groceries

Write a comment